Mobile Trading for Advisors – Wealthscape℠ Pro Mobile

In January 2024, Fidelity Investments launched the Wealthscape℠ Mobile app on the Apple App Store and Google Play Store. As part of its ongoing evolution, the app is expanding to support mobile trading for advisors, specifically targeting equities and ETF trading for Custody clients. This feature is currently in the discovery phase, with an MVP release planned for Q2/Q3 2025.

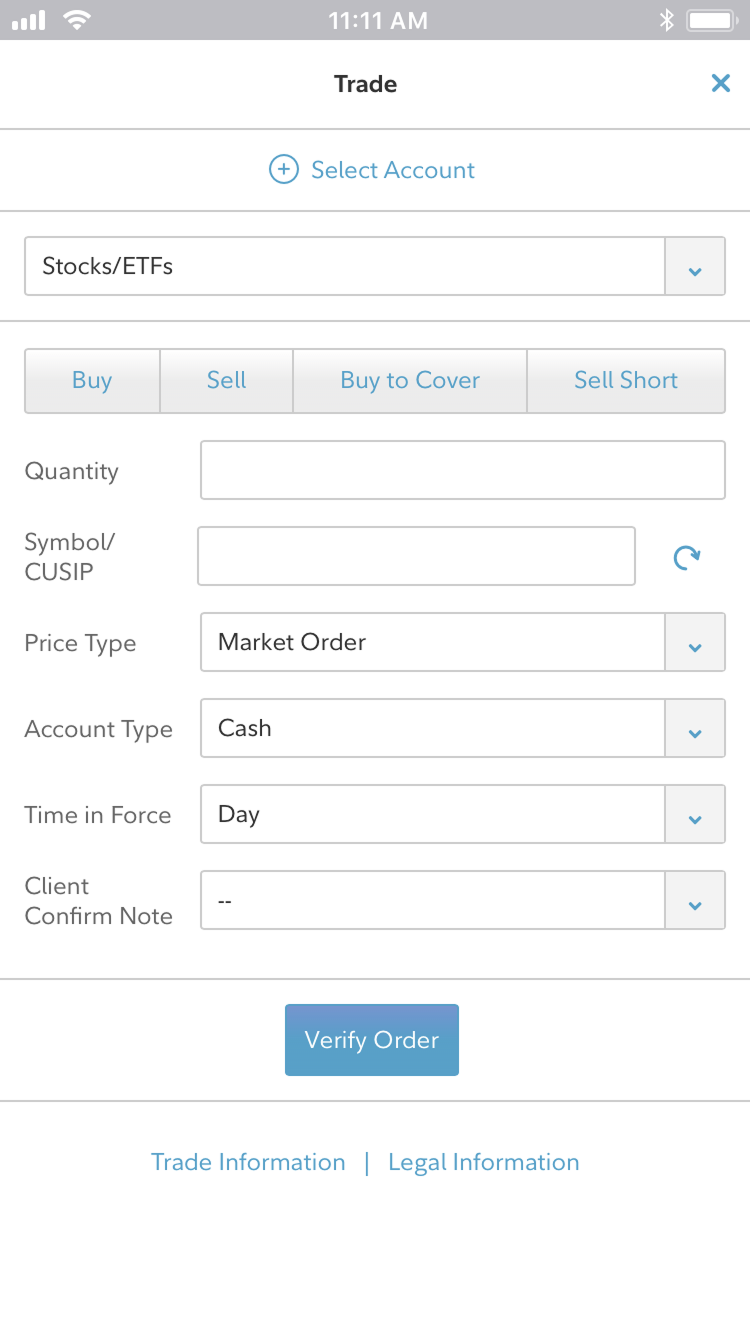

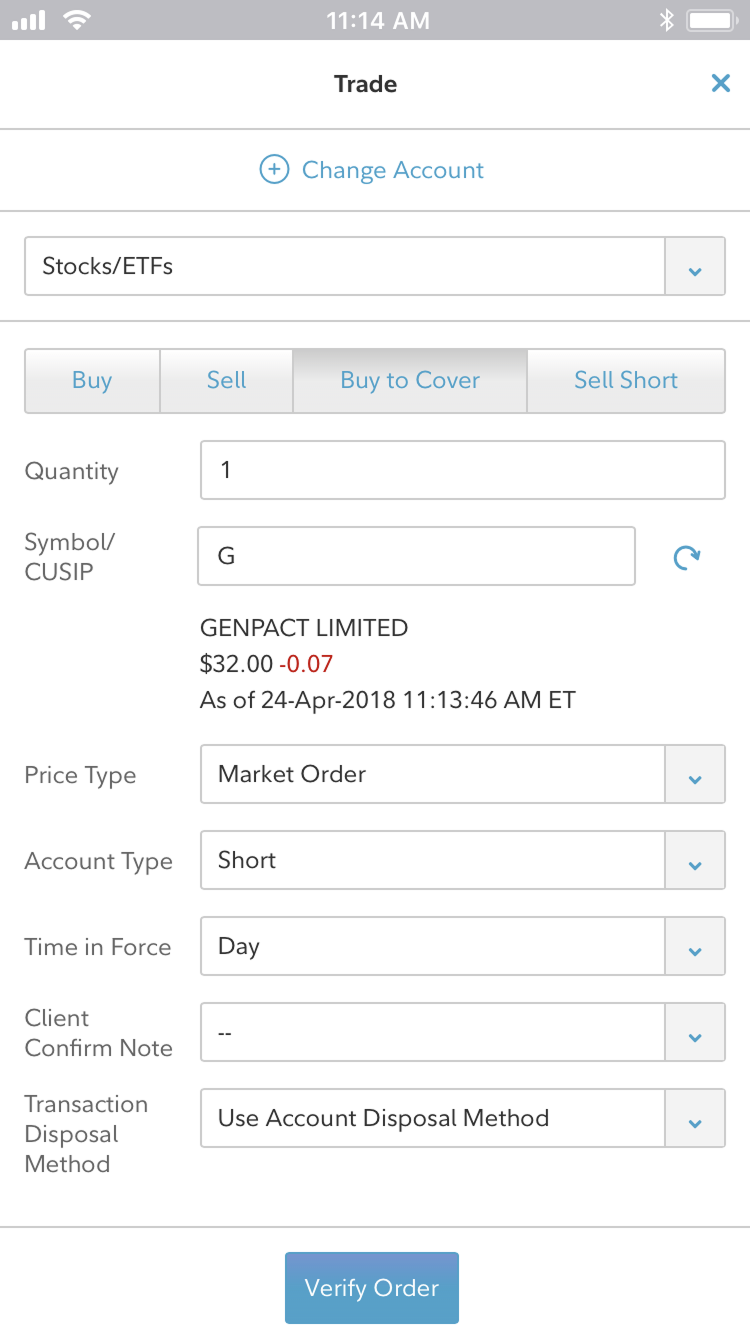

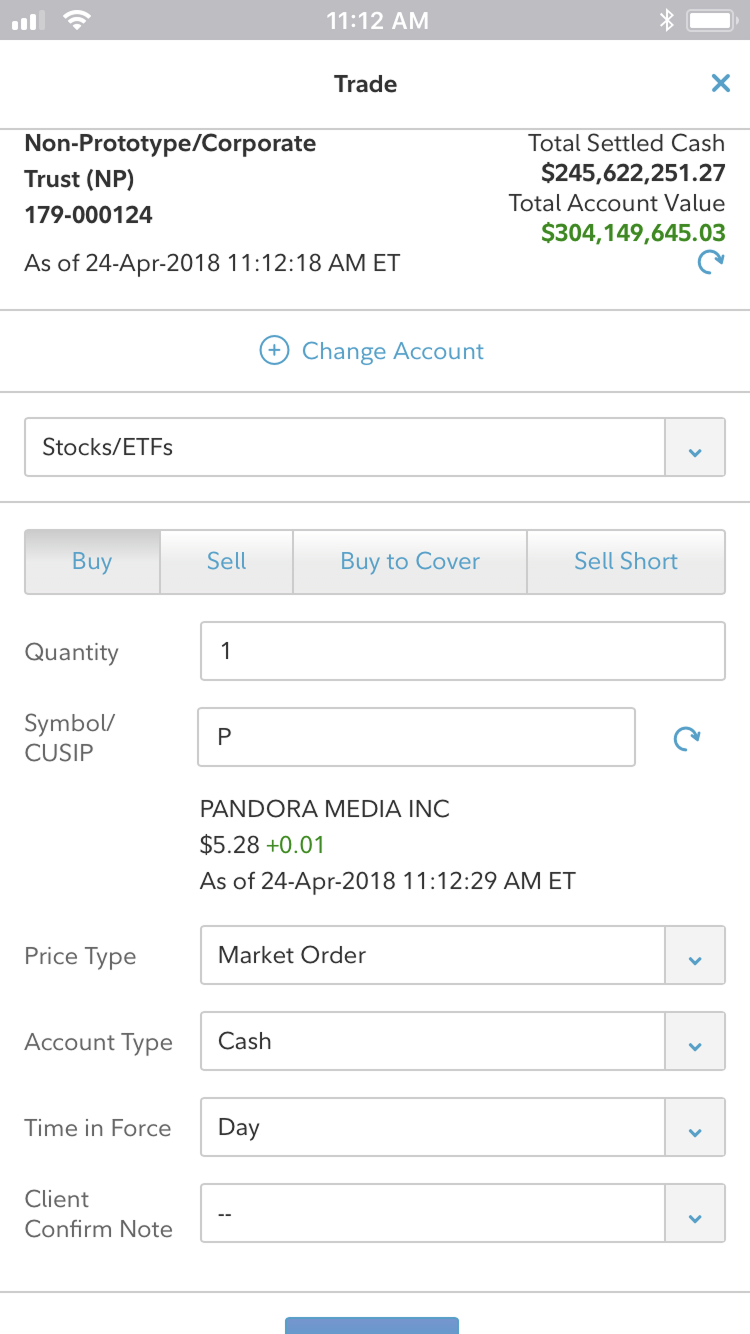

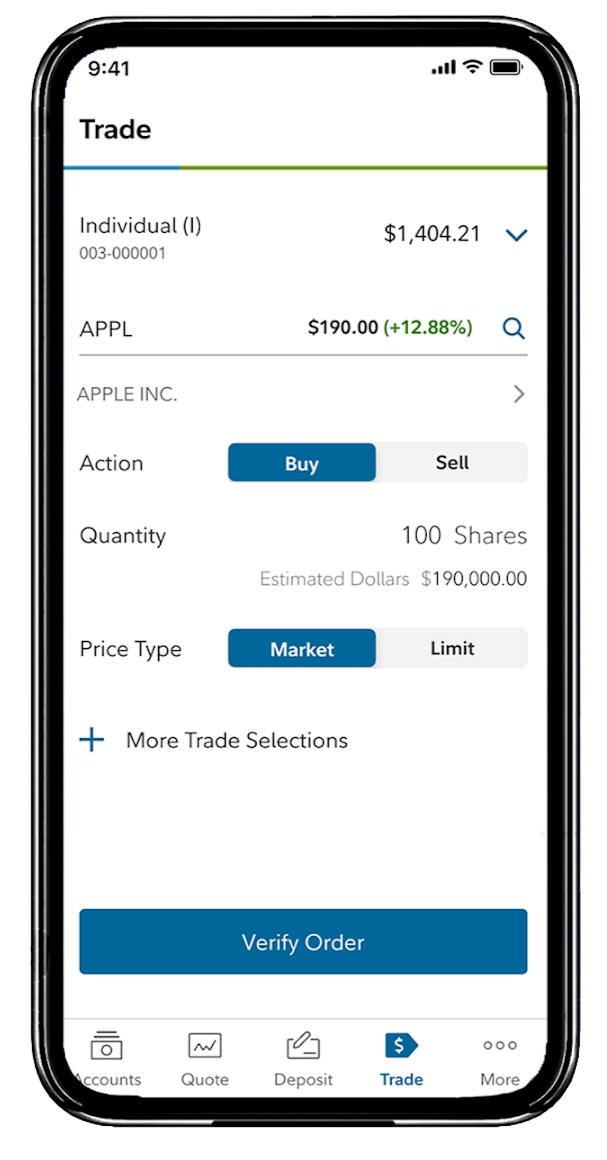

The Trading feature allows entitled users to place equity and ETF orders directly from their mobile devices. It is accessible via the app’s navigation menu and dynamically reveals fields based on user input. The flow includes:

Trade Order Entry: Begins with account and symbol fields; additional fields (e.g., action, quantity, price type) appear contextually.

Quote Detail Access: Tapping the security description opens a detailed quote page.

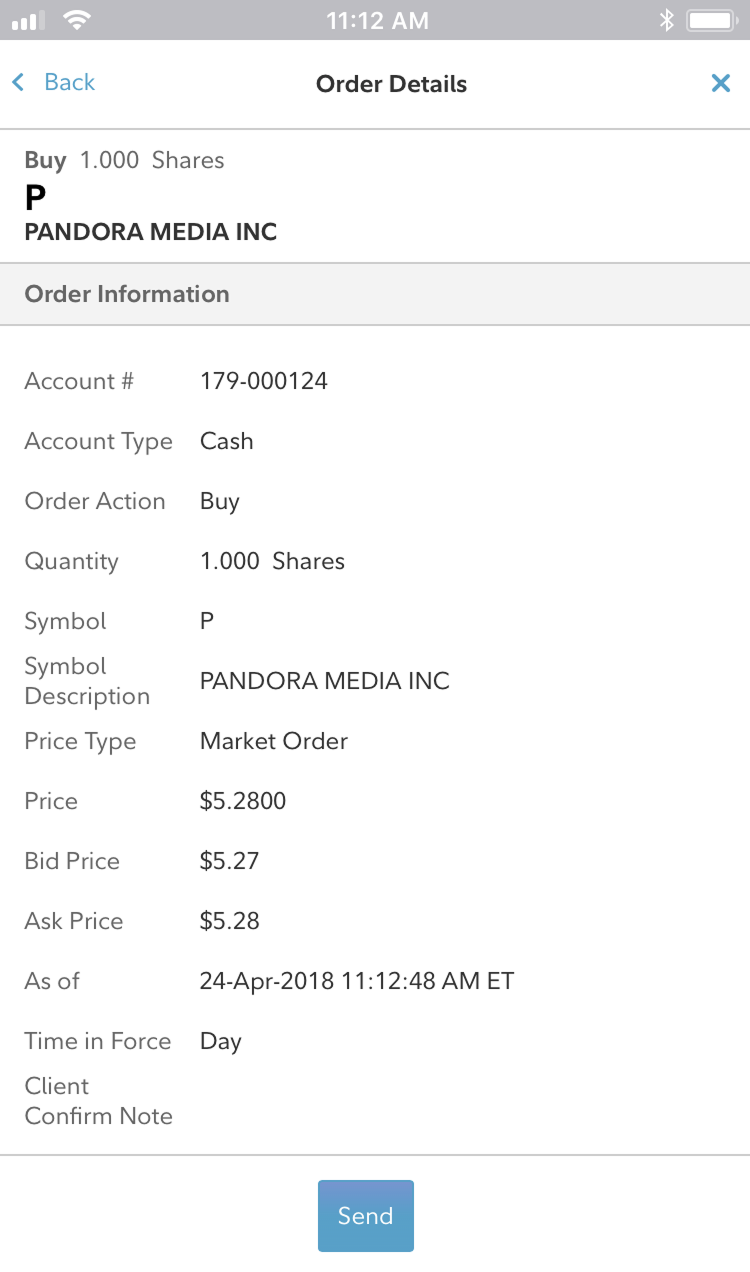

Verification & Confirmation: Orders are validated via backend services before submission. Errors block submission; warnings do not.

Post-Trade Navigation: Users can track orders via the Activity page or return to the Account list.

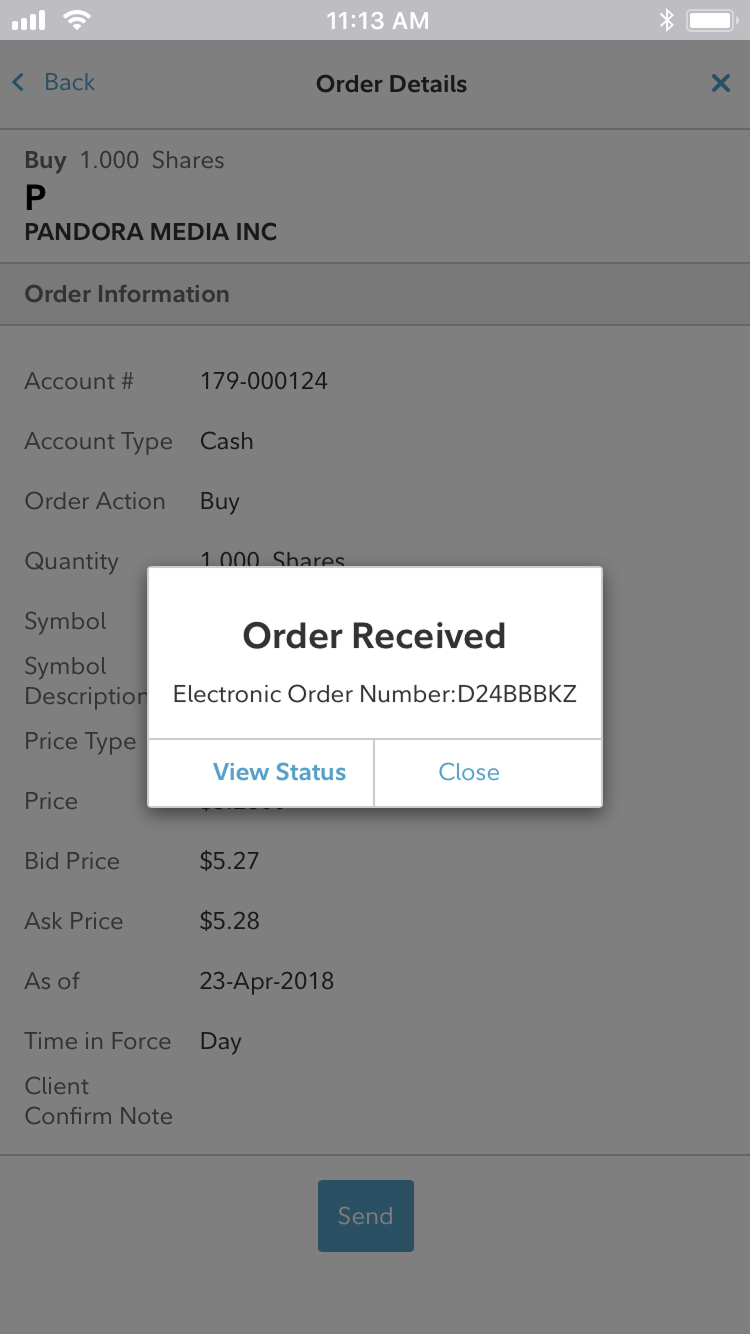

Classic Wealthscape℠ Mobile Trading (Pre-2024)

Before the 2024 refresh, the Wealthscape℠ mobile app provided advisors with access to essential brokerage functions in a secure, portable format. While the app supported features like account summaries, positions, balances, activity tracking, and mobile check deposit, trading capabilities were limited or non-existent for many users. The experience was primarily focused on viewing rather than executing trades, and any trading functionality that did exist was not optimized for mobile workflows. The app lacked dynamic field behavior, real-time quote integration, and contextual validation—features that are now central to the redesigned trading experience.

Design Reuse Across Platforms

Before the trading feature work in Wealthscape Pro Mobile, Wealthscape Investor (WSI) had already implemented a mobile trading experience. As part of the discovery phase for WS, the team evaluated the WSI trading flow to determine if it could be adapted for advisors.

The decision was made to leverage the existing WSI design as a foundation for the WS advisor experience. This approach allowed the team to:

Accelerate development by reusing proven interaction patterns

Maintain consistency across the t wo mobile platforms

Validate design assumptions through prior WSI user feedback

While the core structure remains similar, the WS version is being tailored to meet the unique needs of advisors, including entitlement checks, account-level trading nuances, and enhanced verification flows.

Google Playstore Reviews

“Easy to use and navigate. I like being able to place trades and check balances on the go.”

“The app is very intuitive. Trading is straightforward and I appreciate the real-time quotes.”

“Great app for managing investments. I’ve used it to submit ETF orders without any issues.”

“Smooth experience. I like how the trade ticket only shows what you need when you need it.”

Research

To evaluate the usability, discoverability, and comprehension of a simplified mobile trading ticket for advisors using the Wealthscape Pro Mobile app.

Study Type: Remote unmoderated usability testing

Participants: 5–6 advisors (ages 26–47) in financial services who regularly submit trades and use mobile devices for work

Tasks: Participants completed a trade using a prototype and provided feedback on the experience

Prototype: Figma Link (Password: from-spice-mesh-diary)

The Trading feature allows users to place equity and ETF orders on selected accounts. It is accessible via the app’s navigation menu and is only visible to users entitled to equity trading.

Key Findings

Users want to see client name and account type

Recommendation: Add these next to account number

Priority: Moderate

Users want to trade by dollar amount

Recommendation: Allow switching between shares and dollar value

Priority: Minor

Users want to see cash available and total trade value

Recommendation: Display both during order entry

Priority: Minor

Users want to see past performance and AI tips

Recommendation: Consider adding visual insights and contextual tips

Priority: Insight

Unanswered Questions

From which screen (account vs. trade) do users prefer to initiate a trade?

How can we encourage more mobile trading among advisors who currently prefer desktop?

How do entitlement mismatches and quote data discrepancies affect the experience?

Technical Considerations

Dynamic Field Visibility: Fields appear based on user input (e.g., Price Type reveals Limit Price).

Validation Rules: Run in sequence; errors shown one at a time.

Quote Types: Real-time vs. delayed quotes depend on entitlement.

Error Handling: Errors and warnings are surfaced from the Order Entry Service and linked to an “Important Information” page.

Next Steps

Refine UI to reflect entitlement logic and backend validation.

Prioritize enhancements based on research severity ratings.

Explore MVP 2 opportunities for alternate trade initiation points.

Collaborate with legal and compliance to finalize quote and disclaimer placements.